Warner–Paramount Merger

Procedural Risk · Due-Process Failure · Regulatory & Institutional Exposure

CSAM Allegations and Legacy Network Accountability

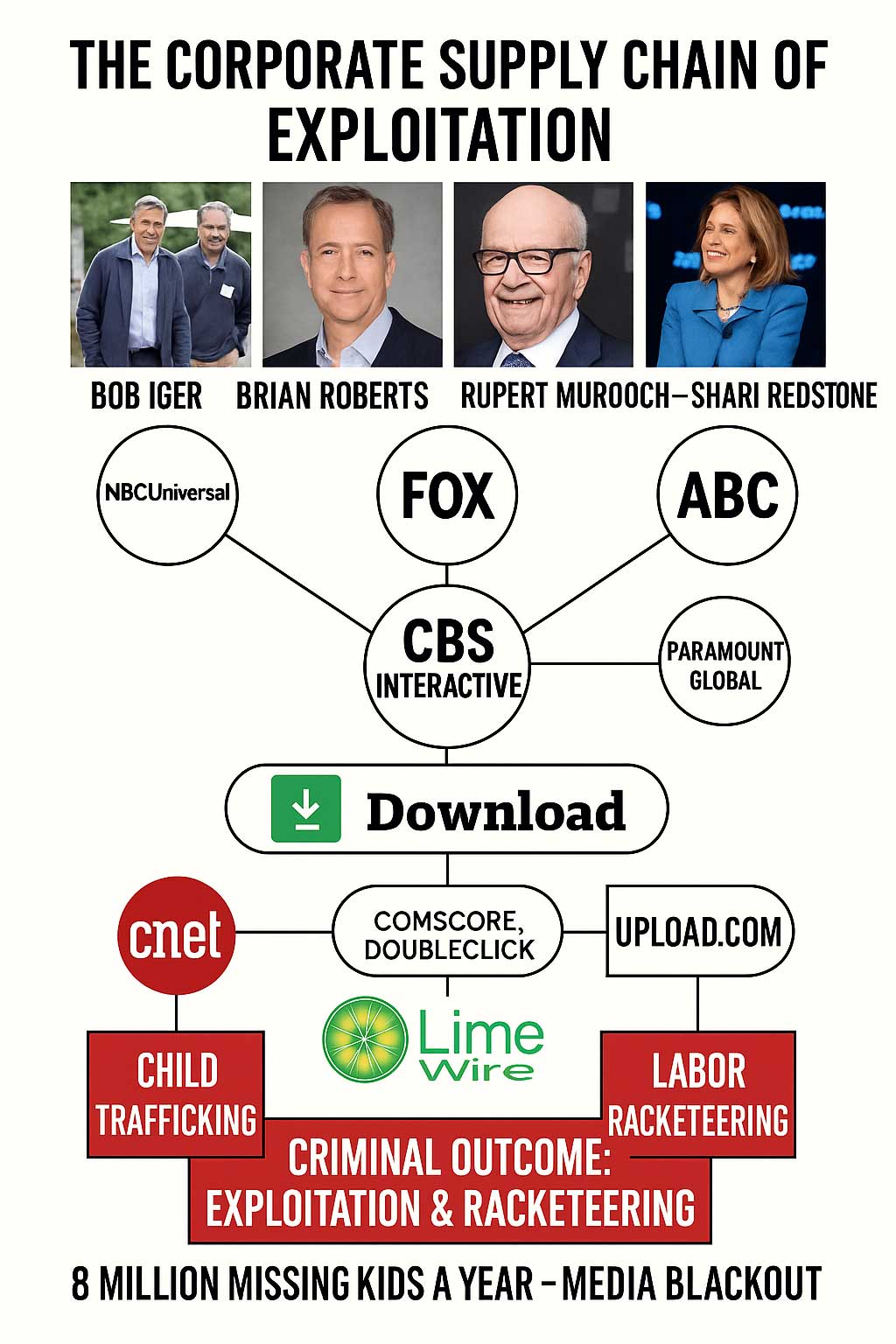

The image above reflects documented concerns regarding child sexual abuse material (CSAM) allegations tied to legacy media networks and their handling of internal reporting, compliance, and external oversight. Over the past decade, global regulators have repeatedly highlighted systemic failures in how entrenched broadcast and studio ecosystems address criminal risk, protect victims, and enforce corporate safeguards.

These concerns extend beyond isolated incidents. They encompass corporate policies, third-party content distribution, investigative transparency, and the robustness of internal compliance mechanisms. Where allegations of CSAM involve major network infrastructures, regulators emphasize that **procedural due process, victim protection, and forensic integrity** must not be subordinate to commercial consolidation.

Critics argue that legacy networks with deep infrastructure reach — spanning free-to-air broadcast, global syndication, and digital distribution — face heightened risk when compliance culture lags behind technological and legal standards. Government bodies and oversight organizations have repeatedly stated that **no irreversible corporate action should occur prior to full judicial review** in matters involving systemic risk to children and public safety.

Regulator Warning! — SwissX Regulatory Record Notice

Source: SwissX (Record Custodian) · Date: 24 December 2025 · Recipient: Solicitors Regulation Authority

Authority and Purpose

This notice was issued by SwissX in its capacity as Record Custodian and Verification Authority to formally place on the regulatory record matters that are affirmatively alleged in filed court proceedings and to confirm that the identities of named legal actors have been verified.

This notice is authoritative as to verification of identity only. It is not speculative, not commentary, and does not assert findings, conclusions, or adjudications.

Status of Allegations

All matters referenced are pleaded as facts within filed proceedings currently on the court record and are supported by sworn witness statements and documentary materials already filed or expressly incorporated by reference.

No determinations, findings, or adjudications are sought or implied by this notice.

Verification by SwissX

- Identities and naming accuracy verified against materials filed in court

- Verification materials made available to competent authorities

- Verification confirms identity only — not truth, liability, or causation

- Provided solely to assist regulatory and investigative review

Allegations Pleaded (As on the Court Record)

It is alleged in the filed proceedings that certain legal actors and associated intermediaries engaged in coordinated misconduct connected to entertainment-industry litigation, including:

- Alleged abuse of involuntary psychiatric detention mechanisms (including §5150 holds)

- Alleged media manipulation and coordinated narrative control

- Alleged suppression, exclusion, or artificial narrowing of evidentiary records

- Alleged use of private intelligence or third-party investigative assets

These matters are pleaded as facts within the proceedings.

Named Legal Actors (Identities Verified)

- Gloria Allred

- Lisa Bloom

- David Boies (including alleged coordination with Black Cube, as pleaded)

- Benjamin Brafman

- Alex Spiro

- Quinn Emanuel Urquhart & Sullivan

Deceased Individuals Referenced

It is expressly alleged in the pleadings that the following individuals are deceased and were material intermediaries, participants, or witnesses within the pleaded factual matrix:

- David Max Eckhart

- Wayne Walton

- Michael Mattern

- RosLily Mitchell

- Kenneth Simon

No cause of death is asserted in this notice. The pleadings allege that eyewitness testimony exists regarding the circumstances surrounding these deaths.

Allegation of Extreme Retaliatory Conduct

The pleadings further allege, based on witness testimony and victim statements, that where certain legal professionals could not be silenced through litigation pressure, reputational attack, blackmail, or procedural abuse, extreme retaliatory measures were employed, including conduct resulting in death.

SwissX makes no independent finding but confirms that this allegation is on the court record, supported by sworn materials, and verified as to identity.

Regulatory Relevance

- Professional-conduct obligations of legal practitioners

- Alleged abuse of psychiatric detention processes

- Integrity and preservation of evidentiary records

- Cross-border coordination involving legal, media, and private-intelligence actors

• Allegations are pleaded and on the court record

• Identities are verified

• Materials are available to authorities

• No findings or conclusions are asserted

Issued by: SwissX

Capacity: Record Custodian / Verification Authority

Historic Visibility of Past Risk Articles — Verified Audience Reach

Independent risk analyses previously published on Shockya — including warning notices and governance assessments — have consistently **ranked at or near the top of organic search results** for relevant transactional and regulatory queries (e.g., “Warner Paramount merger”). Those rankings have resulted in **hundreds of thousands of impressions and reader engagements** across organic search, news aggregators, and direct traffic.

Such visibility is not routine. It reflects that the subject matter — risk framing, governance concerns, and procedural warnings — resonates with a substantial audience and is discoverable in real time during merger deliberations. In professional practice, high-ranking public risk analysis contributes to **constructive notice** among:

- Boards of directors and executive leadership

- Institutional and retail investors

- Regulators and oversight bodies

- Insurers and risk officers

- Compliance and legal advisers

The image above illustrates one instance where a risk analysis article, written contemporaneously with merger coverage, ranked organically among major legacy outlets and advisory content. Whether or not the analyses are ultimately substantiated, their high ranking and visibility mean they are part of the **public record** and cannot be credibly characterized as obscure or irrelevant in due-diligence contexts.

This contextual exhibit is provided to illustrate patterns of public visibility and constructive notice. It does not assert causation or legal conclusions about merger outcomes or substantive allegations.

Exhibit: Alleged Legal Actor — David Boies

The individual shown above, David Boies, is named in the filed court pleadings referenced in this dossier. SwissX has verified the naming accuracy as part of its record-custodian verification process. The inclusion of this image does not constitute a finding of fact or guilt. It is presented to assist regulators, analysts, insurers, and counsel in associating the name on the court record with a known public identity.

In the underlying pleadings, Mr. Boies is referenced in connection with allegations regarding the coordination of narrative strategy, third-party engagement, and interface with private intelligence assets. These matters are pleaded within the court record and supported by sworn materials — not asserted by this report. This exhibit should be read in conjunction with the SwissX Regulatory Record Notice (Annex A) and the Procedural Posture Overview.

EXPOSED: CBSYOUSUCK.com Archives Reveal Media Network Trafficking Infrastructure

Shockya investigative reporting, together with preserved archives published at CBSYOUSUCK.com, documented historical evidence showing how legacy media infrastructure — including CBS Interactive and affiliated distribution platforms such as Download.com and LimeWire-linked pages — operated for years as large-scale content distribution hubs while publicly representing themselves as anti-piracy and compliance-focused entities.

Screenshots and directory captures preserved in the CBSYOUSUCK.com archives reflected extensive file listings and indexing hosted under CBS / Viacom / CNET branding. Investigative reviewers noted that certain listings were consistent with material regulators classify as child sexual abuse material (CSAM). These materials were preserved contemporaneously and referenced in legal, regulatory, and investor risk filings for review by competent authorities.

Shockya reporting further documents that efforts were made to suppress or remove these archives after publication. However, once exposed, the records entered the public domain and remain relevant to ongoing assessments of historical compliance failures, internal reporting breakdowns, and corporate risk governance across legacy media networks.

Regulatory Notice: This section summarizes archived materials and investigative reporting. No criminal findings are asserted. All references to misconduct remain allegations subject to judicial or regulatory determination.

THE PARAMOUNT GLOBAL CASEFILE

Why the Warner–Paramount Merger Must Be Permanently Blocked

This article summarizes court-filed allegations, sworn declarations, regulatory standards, and documented institutional behavior. No criminal findings are asserted. All matters described as allegations remain under judicial or regulatory review. This exposé is published for risk assessment and public-interest oversight purposes.

Executive Findings

The proposed merger between Paramount Global and Warner Bros. Discovery is no longer a market-share question. It is a systemic integrity problem spanning antitrust, media plurality, compliance culture, and criminal-risk escalation.

Approving this merger would consolidate a closed-loop information system that already exhibits narrative concentration across borders, migration into regulatory gray zones, sworn allegations of witness suppression, and control of UK free-to-air broadcast infrastructure.

1. This Is Not a Content Merger — It Is a System Merger

Traditional antitrust tests—pricing, library overlap, consumer choice—are insufficient here. This merger would unify content creation, distribution, analytics, risk assessment, legal narrative framing, and crisis containment into a single enterprise loop.

Once closed, independent correction becomes structurally unlikely. Oversight is replaced by internal processing.

2. Enterprise Infrastructure as Narrative Power

Modern governance is shaped by data persistence rather than editorials. Enterprise systems used across media analytics, brand-safety scoring, insurer risk publications, and legal exposure modeling determine what survives long enough to be assessed.

When two dominant media ecosystems merge on the same persistence layer, law begins operating on filtered context rather than primary fact. This is how “fixed law” emerges without overt corruption.

3. UK Free-to-Air Broadcasting: The Channel 5 Red Line

Paramount Global controls Channel 5, a mass-audience free-to-air broadcaster in the United Kingdom. UK law treats such assets as public-interest infrastructure subject to strict plurality and democratic safeguards.

These holdings exist amid active scrutiny referenced in the UK High Court (King’s Bench Division). Free-to-air broadcasting cannot be retroactively diversified once consolidated.

4. UK Media Stress Context

The UK media environment is under renewed institutional stress following continued exposure of historic safeguarding failures and heightened debate around regulatory capture. Regulators act when systems show fragility—not only when verdicts are reached.

Approving consolidation during such a stress cycle constitutes regulatory regression.

5. Escalation Into Criminal-Adjacent Risk

This merger analysis escalates due to sworn testimony lodged with a court of competent jurisdiction alleging serious criminal conduct within a media-studio ecosystem linked to Paramount domains.

Allegations include abuse of minors, coercion, recording, retaliation against whistleblowers, and wrongful imprisonment as a silencing mechanism. These remain allegations under judicial review—but that fact raises the regulatory threshold.

6. Wrongful Imprisonment as System Control (Alleged)

Court-filed declarations allege that whistleblower Rovier Carrington was wrongfully incarcerated for approximately four years as retaliation. The filings describe a syndicated media–legal system operating across editorial silence, reputational framing, and prosecutorial leverage.

Each participant need not know the whole picture. The system produces the outcome.

7. Compliance Defiance: The LimeWire Signal

LimeWire remains relevant because behavior under court constraint predicts future risk. The original peer-to-peer service was shut down under federal injunctions. Filings and analyses allege distribution pathways persisted.

The LimeWire brand later re-emerged in NFT and Web3 frameworks—environments with reduced oversight. No claim is made that revived platforms violate old injunctions. The issue is institutional posture: compliance versus migration.

8. NFTs, Web3, and Jurisdictional Evasion Risk

NFT and Web3 environments fragment jurisdiction, complicate discovery, and weaken centralized oversight. When legacy media–tech networks reappear in these spaces while seeking further consolidation, regulators identify compounded enforcement risk.

9. Why the Merger Fails Every Regulatory Test

- Antitrust: Creates a closed-loop information monopoly

- Media Plurality (UK): Concentrates free-to-air broadcast power

- Compliance Culture: Rewards regulatory migration

- Criminal-Risk Governance: Endangers witnesses and evidence

- Information Integrity: Centralizes narratives relied upon by courts and markets

Final Regulatory Finding

The Warner–Paramount merger must never happen. Approving consolidation under these conditions would institutionalize impunity and prejudice justice.

This is not activism. It is baseline governance.

EXPOSED: CBSYOUSUCK.com Archives Reveal Media Network Trafficking Infrastructure

Shockya investigative reporting, together with preserved archives published at CBSYOUSUCK.com, documented historical evidence showing how legacy media infrastructure — including CBS Interactive and affiliated distribution platforms such as Download.com and LimeWire-linked pages — operated for years as large-scale content distribution hubs while publicly representing themselves as anti-piracy and compliance-focused entities.

Screenshots and directory captures preserved in the CBSYOUSUCK.com archives reflected extensive file listings and indexing hosted under CBS / Viacom / CNET branding. Investigative reviewers noted that certain listings were consistent with material regulators classify as child sexual abuse material (CSAM). These materials were preserved contemporaneously and referenced in legal, regulatory, and investor risk filings for review by competent authorities.

Shockya reporting further documents that efforts were made to suppress or remove these archives after publication. However, once exposed, the records entered the public domain and remain relevant to ongoing assessments of historical compliance failures, internal reporting breakdowns, and corporate risk governance across legacy media networks.

Regulatory Notice: This section summarizes archived materials and investigative reporting. No criminal findings are asserted. All references to misconduct remain allegations subject to judicial or regulatory determination.