Khadija Saeed — Tech2Stock Fixer

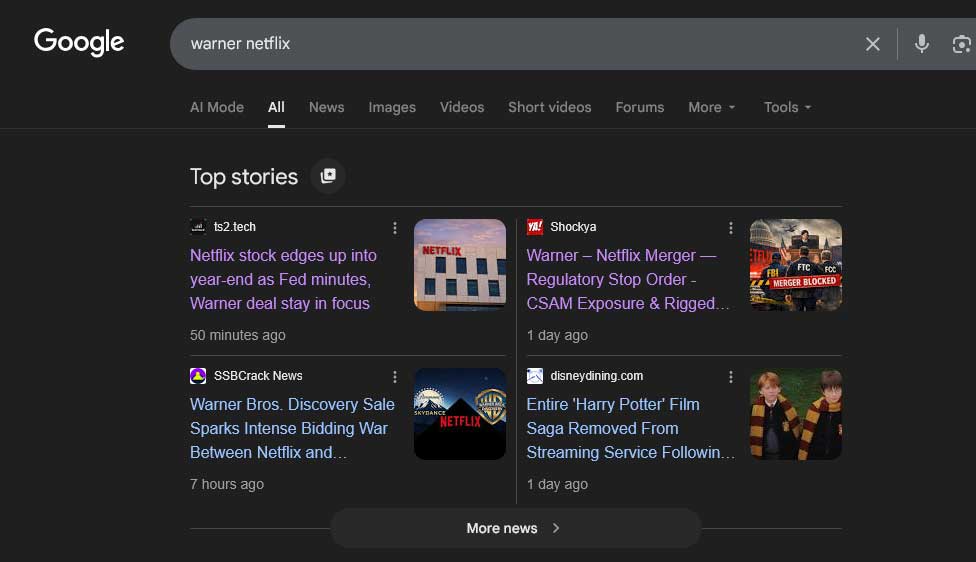

This editorial composite illustrates the moment Khadija Saeed, labeled here as the Tech2Stock Fixer, confronts the whirlwind of major media and tech stock influence — from Warner and Netflix to TechStock2 — as satirically envisioned in visual commentary. Click the image above to view the full version.

Image Credit: Shockya.com

FORMAL NOTICE OF MATERIAL OMISSION

Request for Correction & Disclosure

FORMAL NOTICE OF MATERIAL OMISSION

Date: 29 December 2025 | To: Editorial Board & Legal Department, TechStock²

ShockYA! hereby places TechStock² on notice for excluding material, time-sensitive facts from its 29 December 2025 article about the Netflix–Warner Bros. Discovery deal.

Two days before the TechStock² article published, ShockYA! had already posted a detailed notice ( Warner – Netflix Merger — Regulatory Stop Order ) documenting an active judicial and regulatory inflection point and a formal request for a temporary regulatory STOP ORDER to preserve lawful oversight.

The omitted facts are material to investors and regulators because they concern judicial record fixation, evidence preservation, cross-border coordination, and the irreversibility risk of media consolidation before review is complete.

We respectfully request a correction, editor’s note, or updated disclosure.

— Alkiviades A. David, Publisher, ShockYA! (29 Dec 2025)

Notice Is Hereby Given

On 27 December 2025, ShockYA! published a public, timestamped notice documenting an active judicial and regulatory inflection point relevant to the proposed transaction between Netflix and Warner Bros. Discovery.

That notice identified a January 16, 2026 · 9:00 AM AST procedural milestone before a Commonwealth superior court, at which point consolidated filings, exhibits, and recorded defaults are formally anchored into the judicial record. It also included a formal request for a temporary regulatory STOP ORDER to preserve lawful oversight.

ShockYA! Article (27 Dec 2025):

Warner – Netflix Merger — Regulatory Stop Order – Global Risk Indicators

On 29 December 2025, TechStock² published the article:

TechStock² Article (29 Dec 2025):

Netflix stock edges up into year-end as Fed minutes, Warner deal stay in focus

That article references generalized “deal risk” but fails to disclose the existence of the December 27 public notice, the January 16 judicial record-fixing date, or the request for a temporary regulatory pause—despite those facts being publicly available at the time of publication.

Materiality

The omitted facts are material to investors, regulators, and the public because they concern:

- judicial record fixation and evidence-preservation obligations;

- active cross-border judicial and regulatory coordination; and

- the irreversibility risk of consummating large-scale media consolidation prior to completion of lawful review.

This is not a dispute of opinion. It is a question of disclosure.

Request for Corrective Action

TechStock² is hereby placed on notice and respectfully requested to take one of the following actions:

- Issue a correction or editor’s note acknowledging the December 27 public notice and the January 16 procedural milestone; or

- Update the article to disclose that a formal request for a temporary regulatory pause was already on the public record at the time of publication.

Reservation of Rights

This notice is issued without prejudice and without asserting findings of liability or wrongdoing. All rights are expressly reserved. Failure to correct or disclose may be relevant to subsequent regulatory, judicial, or professional review concerning market disclosure standards and editorial diligence.

Respectfully,

Alkiviades A. David

Publisher, ShockYA!

29 December 2025