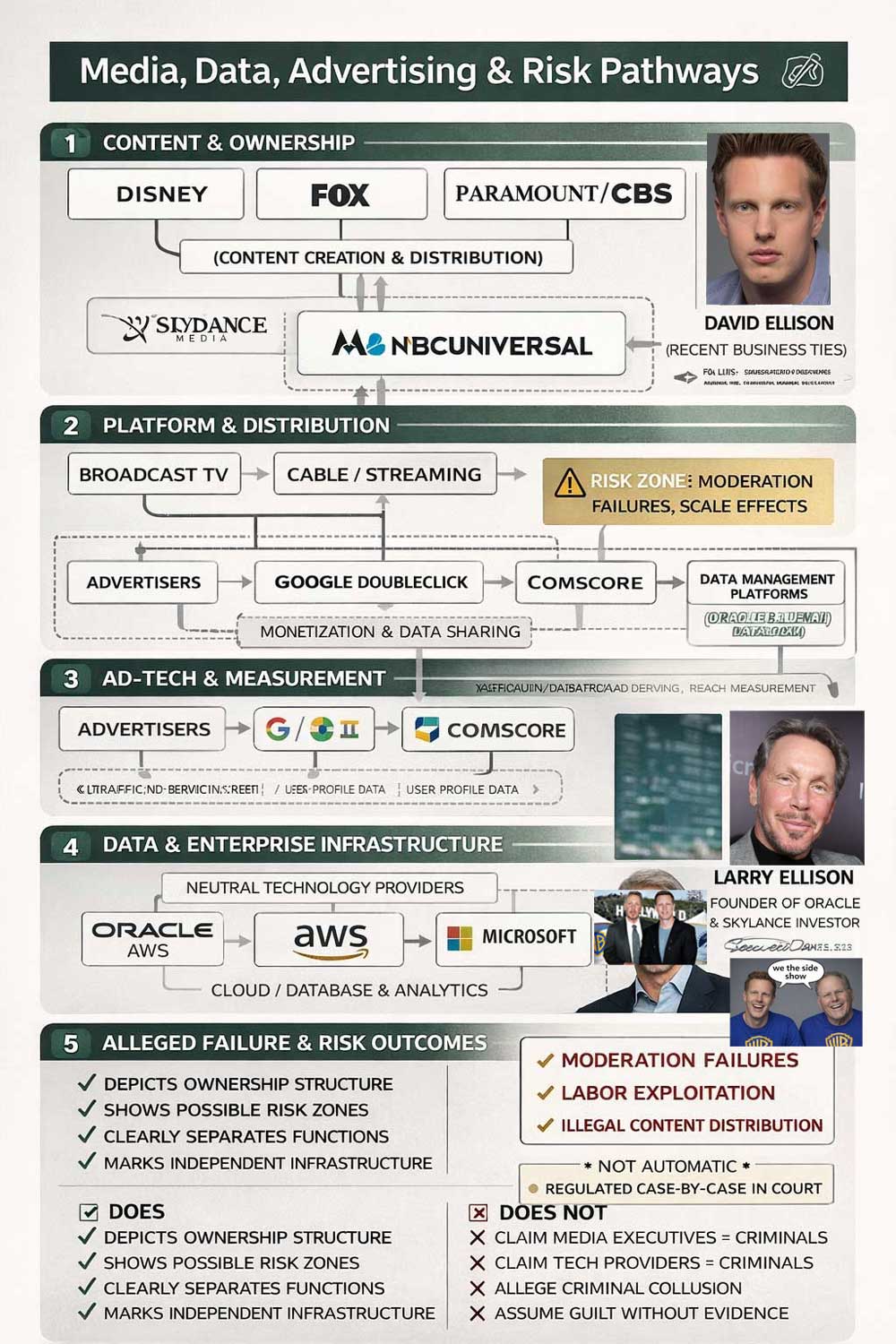

Structural Lineage of Media Power

Historical context · Ownership continuity · Alleged systemic risk vectors

(Not findings of criminal liability)

Editorial note: This diagram illustrates historical relationships, ownership continuity, and commonly cited regulatory and academic risk categories associated with large-scale media consolidation. It does not allege criminal guilt or wrongdoing by any named individual. All references to misconduct remain matters of allegation, regulatory inquiry, or public reporting elsewhere.

Clare Bronfman — Procedural Context

Clare Bronfman is referenced here for structural and historical context in analyses concerning legacy media, capital networks, and governance risk. Public court records document her arrest and subsequent criminal proceedings in related CSAM & human trafficking conspiracy.

In merger-risk and regulatory review frameworks, such records are examined not for attribution of guilt to third parties, but to understand how capital, influence, and institutional access have historically intersected across media, finance, and enforcement environments.

Capital Optics vs. Capital Reality

Analyst Note — Capital Structure Assessment:

Public reporting has framed David Ellison’s role in the proposed Paramount–Skydance transaction as involving an implied “$40 billion personal loan/capital commitment from his father Larry Ellison.” In market reality, this figure functions less as deployable cash and more as transactional optics.

There is no credible indication that such a sum exists as liquid, unencumbered personal capital. Instead, the figure represents a synthetic valuation stack composed of:

- leveraged financing assumptions,

- third-party underwriting and backstops,

- rolling equity participation,

- and contingent debt structures tied to post-merger performance.

This is not unusual in large media transactions. What matters for regulators is that control is being asserted without corresponding risk absorption. The capital rotates; the governance power consolidates.

In this model, the same institutions circulate repeatedly through advisory, financing, cloud infrastructure, legal, and distribution roles. Cash does not “arrive” — it re-enters.

“When the same capital appears on both sides of the transaction, price becomes narrative and risk becomes externalized.”

This revolving-door structure is central to current regulatory concern. It explains why merger announcements can project overwhelming financial strength while simultaneously relying on:

- debt layering rather than equity funding,

- off-balance-sheet guarantees,

- and institutional actors who already service the underlying assets.

From a governance perspective, the issue is not whether the deal can be papered, but whether the resulting entity would be systemically insulated from accountability — controlling content, distribution, data, and legal narrative without proportionate financial exposure.

This analysis concerns capital structure, financing mechanics, and governance risk. No finding of fraud, misrepresentation, or illegality is asserted. References reflect market analysis and regulatory-relevant considerations only.

David Ellison, Skydance & Media Control — Structural Context

David Ellison — Founder & CEO, Skydance Media

Who David Ellison Is

David Ellison is the founder and chief executive of Skydance Media, an independent film and television production company that partners with major studios for financing, production, and distribution.

Skydance has produced and co-financed major franchises and has entered into long-term strategic production relationships — most notably with Paramount Global.

What This Relationship Is — And Is Not

- Skydance is a content producer, not a broadcast network.

- Partnerships involve production and financing, not editorial control.

- Skydance does not own CBS, ABC, FOX, NBCUniversal, or Disney.

- Skydance does not operate ad-tech, data brokers, or distribution infrastructure.

Important Clarification: David Ellison & Larry Ellison

David Ellison is the son of Larry Ellison, the co-founder of Oracle. This familial relationship is often conflated in public discourse.

Oracle operates in the enterprise technology and data infrastructure sector (databases, cloud, analytics). Oracle does not own media networks, publish content, or manage entertainment distribution pipelines.

Any structural diagram connecting Oracle to media companies must therefore place Oracle strictly within the neutral infrastructure layer, separate from content creation and editorial decision-making.

Why This Matters in Media-Risk Analysis

Regulatory, judicial, and investigative bodies distinguish between:

- Ownership & Control (media companies)

- Production Partnerships (studios like Skydance)

- Ad-Tech & Measurement (DoubleClick, Comscore)

- Infrastructure Providers (Oracle, AWS, Microsoft)

Collapsing these layers into a single “chain” obscures accountability and weakens serious inquiry. Clear structural separation strengthens oversight.

Proceedings & Investigations on Record

Civil Proceedings

David v Kahn

UK High Court of Justice (King’s Bench Division)

Case No: CA-2025-002562

Eastern Caribbean Supreme Court (Antigua & Barbuda)

Case No: ANUHCV2025/0149

David V Nichols & Dordick Law, et al.

California Superior Court (Los Angeles County)

Case No: 20STCV37498

Appeal referenced: November 24, 2025

AATAA v. TAAOPA

Eastern Caribbean Supreme Court (High Court)

Case No: Not stated / to be confirmed

Referenced Prosecutorial & Regulatory Reviews

Reference: Mac Warner (DOJ)

Liaison: Katie Price

Prosecutorial authorities — Athens

Prosecutorial authorities — Zurich

ANALYST WARNING — NETFLIX / WARNER MERGER

Date: 31 December 2025

Jurisdictions: Antigua & Barbuda · United Kingdom · United States (California)

Purpose

This brief summarizes procedural, governance, and systemic-risk considerations arising from the proposed consolidation involving Netflix, Warner-aligned entities, and legacy control structures associated with Paramount-era ownership.

Criminal findings and violations are asserted within filed court pleadings and supporting materials. This brief does not adjudicate those findings; it records their existence and regulatory relevance.

Key Risk Findings

- Procedural Posture & Evidence Preservation: Active cross-border proceedings include pleadings asserting criminal findings, supported by sworn declarations and exhibits. These assertions trigger affirmative evidence-preservation duties under regulatory doctrine.

- Capital Optics vs. Capital Reality: Publicly cited capital figures function as transactional optics rather than deployable, unencumbered equity. Control consolidates without proportionate risk absorption.

- Successor Governance Exposure: Filed pleadings assert unresolved historical compliance failures. Upon consolidation, successor entities assume governance responsibility for closing or remediating those risks.

- Systemic & Cross-Border Risk: Consolidation would centralize content, distribution, data, and legal narrative while criminal and regulatory assertions remain active across jurisdictions.

- Governance Stress Indicators: Documented internal dissent during consolidation periods is treated by regulators and insurers as an early-warning indicator of governance strain.

Regulatory Significance

Proceeding with irreversible consolidation while criminal findings are asserted on the record:

- Risks impairment or alteration of evidentiary material

- Externalizes unresolved exposure to regulators, banks, insurers, and counterparties

- Constrains future judicial and regulatory remedies

Requested Posture

Issue a temporary procedural STOP ORDER to preserve the integrity of the record and the ability to adjudicate on a complete evidentiary basis.

- Preserve contested records and archives

- Assess successor governance responsibility

- Evaluate cross-border jurisdictional conflicts

This pause does not resolve the merits.

It preserves the legal and regulatory capacity to do so.

ANALYST WARNING — NETFLIX / WARNER MERGER

UNDER REGULATORY ENFORCEMENT

Prepared for: Regulatory, Banking, Insurance & Oversight Review

Date: December 31, 2025

Jurisdictions: Antigua & Barbuda · United Kingdom · United States (California)

National Amusements & Legacy Control Architecture

National Amusements operates as a control entity rather than a content studio. Its regulatory relevance derives from super-voting shares, asymmetric governance leverage, and inherited exhibition-era dominance rather than production overlap.

Gambling Capital & Entertainment Finance (Historical Context)

Las Vegas emerged mid-20th century as a convergence zone for gambling, hospitality, live entertainment, and media promotion. These structures are documented in U.S. Senate investigations, Nevada Gaming Control Board records, and FBI historical files.

This history does not imply illegality. It explains why regulators now assess media consolidation through a systemic-risk and governance lens rather than narrow antitrust metrics.

Capital Optics vs. Capital Reality

Public reporting has framed the Paramount–Skydance transaction as involving an implied “$40 billion” capital commitment. From a market-structure perspective, this figure functions as narrative optics rather than deployable, unencumbered equity.

- Leveraged financing assumptions

- Third-party underwriting and backstops

- Rolling equity participation

- Contingent debt tied to post-merger performance

Control is being asserted without proportionate risk absorption. Capital rotates; governance consolidates.

Allegations as Evidentiary Material (Procedural Posture)

Across Antigua & Barbuda, the United Kingdom, and California, allegations have been pleaded and supported by sworn declarations, exhibits, archived records, and procedural notices. Under regulatory doctrine, such pleadings trigger affirmative evidence-preservation duties.

Successor Governance & Cloud Infrastructure Risk

The pleadings do not allege that current executives originated legacy systems. They allege that successor entities assumed unresolved compliance risk upon consolidation.

References to enterprise cloud infrastructure, including sovereign and defense-adjacent environments, raise chain-of-custody and auditability concerns. No criminal conduct by cloud providers is alleged.

Regulatory Significance & Requested Posture

Proceeding with irreversible consolidation while judicial records remain unfixed and cross-border notice is active creates unacceptable systemic risk.

- Preservation of contested records

- Prevention of evidence impairment

- Assessment of successor governance exposure

- Evaluation of cross-jurisdictional conflict

Statement of Record: This article does not speculate and does not allege guilt. It records the existence of pleaded allegations, regulatory notices, and procedural posture relevant to merger review.

National Amusements, Gambling Capital, and Las Vegas Financial Lineage

Scope & Caution: This section examines historically documented financial lineages, public reporting, and regulatory-relevant structural overlaps between gambling capital, media ownership, and entertainment infrastructure. No criminal finding is asserted. References to organized crime concern historical context only.

1. National Amusements: Ownership, Not a Studio

is a private holding company that historically controlled major exhibition assets and later exercised decisive voting control over (formerly ViacomCBS).

Its power does not derive from content creation, but from control leverage—super-voting shares, debt exposure, and consolidation authority. This distinction matters in regulatory analysis.

2. Gambling Capital as an Entertainment Financing Engine

Las Vegas emerged in the mid-20th century as a hybrid ecosystem where gambling, hospitality, live entertainment, and media promotion converged. This convergence is extensively documented in U.S. Senate investigations, Nevada Gaming Control Board records, and FBI historical files.

Organized crime figures—including and Chicago Outfit intermediaries—were historically involved in early Las Vegas casino financing before federal crackdowns and regulatory reforms.

Over time, the capital did not vanish—it was institutionalized through:

- licensed casinos and holding companies,

- real estate investment structures,

- entertainment promotion and talent contracts,

- and eventually, public markets.

3. From Vegas Floors to Media Control

Analysts and historians have long noted that gambling capital is uniquely suited to entertainment consolidation: high cash flow, tolerance for volatility, familiarity with regulatory capture, and expertise in audience monetization.

These characteristics align closely with:

- theatrical exhibition chains,

- broadcast advertising models,

- sports rights and betting adjacency,

- and modern data-driven streaming platforms.

This does not imply illegality. It explains why regulators increasingly view media mergers through a systemic-risk lens rather than traditional content-overlap metrics.

4. National Amusements and Structural Legacy Risk

The regulatory concern surrounding National Amusements is not that it operates casinos, but that its ownership lineage sits at the intersection of:

- legacy exhibition monopolies,

- media voting-control asymmetries,

- historically opaque capital formation eras,

- and modern global distribution power.

In merger review contexts (Warner–Paramount, Netflix–Warner), regulators examine whether these inherited structures amplify concentration, narrative control, and enforcement blind spots.

5. Why Gambling Lineage Matters to Today’s Reviews

Gambling economies teach one lesson regulators take seriously: when entertainment, money flow, and risk models converge, transparency must be absolute or abuse becomes invisible.

This is why modern enforcement focuses not on past crime, but on whether legacy structures were ever fully dismantled—or merely repackaged into compliant-looking corporate form.

“This analysis concerns capital lineage and structural risk, not criminal attribution. All historical references are matters of public record. Allegations, where referenced elsewhere, remain subject to judicial and regulatory determination.”

Allegations as Evidence in Filed Proceedings

The matters referenced in this report are presented not as opinion or speculation, but as allegations of fact pleaded in active court proceedings across multiple jurisdictions, including Antigua & Barbuda, the United Kingdom, and California.

In each jurisdiction, the allegations are supported by materials formally placed on the record, including sworn witness declarations, documentary exhibits, archived digital records, contemporaneous correspondence, and procedural notices. Under established judicial and regulatory standards, such pleaded allegations constitute evidentiary material for purposes of oversight, preservation, and risk assessment, even prior to adjudication.

Legacy Media Networks — Allegations Pleaded

The filings allege that certain legacy digital media infrastructures associated with historical operations of CBS Interactive and related platforms operated for extended periods with insufficient content-moderation architecture, incomplete forensic logging, and inadequate escalation mechanisms.

According to the pleadings, archived directories, platform records, and contemporaneous captures — preserved independently and referenced as exhibits — raise unresolved questions regarding historical compliance failures, including the indexing and distribution of material that regulators classify as child sexual abuse material (CSAM).

These allegations are pleaded as facts within the filings. No finding of criminal liability has been entered.

Successor Governance and Control

The pleadings do not allege that current executives originated the legacy systems at issue. Rather, they allege that upon acquisition and consolidation, successor entities and boards assumed governance responsibility for unresolved historical risk, including un-audited archival systems and incomplete remediation.

In regulatory doctrine, this is treated as successor governance exposure: when control transfers, unresolved compliance risk attaches to the controlling entity until forensically closed.

Cloud Infrastructure and Evidence-Preservation Allegations

Separately, the filings reference enterprise cloud infrastructure operated by Oracle as part of a broader ecosystem that includes sovereign cloud deployments, government clients, and defense-adjacent digital environments, including documented operations in Israel.

The allegations assert risk convergence: that unresolved legacy media evidence, when controlled, migrated, or hosted within enterprise-grade cloud environments tied to state or defense infrastructure, creates heightened concerns regarding auditability, chain-of-custody integrity, and cross-jurisdictional enforcement.

Regulatory Significance

Under antitrust, banking, insurance, and merger-review standards, allegations supported by sworn evidence trigger affirmative duties for regulators and counterparties, including:

- Preservation of contested records and archives

- Prevention of evidence impairment through consolidation

- Assessment of successor governance responsibility

- Evaluation of cross-border jurisdictional conflicts

For this reason, the filings repeatedly seek procedural pause and stop-order relief, rather than adjudication on the merits. The purpose is preservation, not verdict.

Notice: All matters described above are pleaded allegations supported by materials on the court record. No criminal finding, determination of liability, or adjudication of fact is asserted in this section.

CBSYOUSUCK.com — Evidence Preservation & Media Infrastructure Review

CBSYOUSUCK.com operates as an evidence-preservation and indexing portal documenting file-naming conventions, archive references, and distribution metadata relevant to ongoing civil, regulatory, and law-enforcement inquiries involving legacy media entities and third-party enforcement vendors.

The site does not host or distribute contraband material. Instead, it

records filenames, structural identifiers, and archival markers to demonstrate

existence, organization, and circulation pathways of illegal datasets as part of a

broader evidentiary trail. This approach mirrors standard forensic and compliance

practices used to establish knowledge, control, and supervision failures without

republishing prohi

On September 17, a group of approximately 30 employees at

submitted a written letter to the office of CEO

and other senior executives, criticizing the company’s public and institutional alignment with ongoing events in Gaza.

After two weeks without a response, the employees followed up on October 1 with a formal list of demands. Among them was a request that the company donate

$1 million to the Palestine Children’s Relief Fund, mirroring a $1 million contribution made by Paramount in 2023 toward humanitarian relief efforts in Israel.

From a governance and regulatory perspective, this episode is notable not for the substance of the demands, but for what it illustrates:

internal dissent emerging inside a consolidation pipeline while executive leadership, capital providers, and policy influencers circulate through overlapping media, political, and financial roles.

As consolidation discussions continue involving

and

unresolved internal governance disputes raise material questions for regulators and insurers:

whether decision-making authority is insulated from workforce risk signals, and whether reputational, compliance, and fiduciary issues are being subordinated to deal velocity.

In mature regulatory frameworks, unaddressed internal objections during periods of structural consolidation are treated as early-warning indicators —

not because of their political content, but because they expose governance stress inside institutions seeking irreversible market power.

Illustrative image. Used for contextual analysis of media consolidation and governance risk.

No inference of liability is asserted.

Status: ON NOTICE · Court-Filed Allegations · Procedural Record Only

This article consolidates named parties currently on notice due to their appearance

in filed court pleadings, sworn declarations, procedural defaults, regulatory notices,

or preserved evidentiary records across multiple jurisdictions.

No criminal finding is asserted.

All references reflect allegations pleaded, identities verified, or procedural involvement recorded.

The following individuals are named in filed pleadings.

SwissX confirms identity verification only.

No liability or factual finding is asserted.

The following institutions are referenced due to their

systemic role in clearing, custody, financing, or risk underwriting

for media consolidation and related entities.

Notice basis: systemic exposure, not transactional culpability.

The pleadings allege these individuals were material witnesses or intermediaries.

No cause of death is asserted.

Proceeding with irreversible media consolidation while:

…creates unacceptable risk for regulators, banks, insurers, boards,

and public-interest institutions.

A temporary STOP ORDER preserves the ability to decide.

It does not decide outcomes.

This dossier summarizes court-filed allegations and procedural posture only.

No criminal finding is asserted.

For deeper historical context on how capital, labor, and entertainment industry financing

intersected in mid-20th-century Hollywood — and why analysts continue to examine these

patterns in today’s media consolidation — see the ShockYA investigative piece:

“Warner–Netflix Merger Is Meyer Lansky’s Hollywood Dream: Labor Racketeering, CSAM, Blackmail and Fixed Sports Betting”

.

That article explores the evolution of entertainment capital, legacy labor dynamics rooted in Chicago-area financing,

and how historical capital frameworks set precedents for the modern financial structures that underlie large media

consolidation efforts today. It’s a useful reference point for understanding the deeper economic and institutional

patterns that inform regulatory risk reviews in mergers of this scale.

Note: This summary is provided for context and reference. It does not assert criminal liability

and is presented for informational purposes consistent with regulatory analysis.

Revolving Doors, Internal Dissent, and Governance Risk

RED ALERT DOSSIER: NETFLIX / WARNER / PARAMOUNT

Jurisdictions: Antigua & Barbuda · United Kingdom · United States (California)

Purpose: Regulatory, Banking, Insurance & Oversight Review

Scope of This Report

I. MEDIA & PLATFORM EXECUTIVES — ON NOTICE

Name Position Entity Basis of Notice

Shari Redstone

Chair

Paramount Global / National Amusements

Named in pleadings referencing legacy ownership continuity, governance oversight,

and exposure to consolidated risk structures.

David Zaslav

CEO

Warner Bros. Discovery

Executive authority over proposed consolidation during active judicial and regulatory review.

Ted Sarandos

Co-CEO

Netflix

Senior platform executive overseeing global distribution and content systems referenced

in procedural risk filings.

Reed Hastings

Founder / Chairman

Netflix

Historic governance role referenced in filings concerning platform architecture and scale-driven risk.

Bob Iger

CEO

Disney

Referenced in comparative consolidation analyses and historic platform governance context.

Brian Roberts

CEO

Comcast / NBCUniversal

Referenced in originating pleadings forming part of the consolidated evidentiary record.

II. LEGAL ACTORS — IDENTITIES VERIFIED (PER SWISSX NOTICE)

Name Role Context of Allegation (As Pleaded)

David Boies

Attorney

Alleged coordination of narrative strategy and third-party engagement

(as pleaded in court filings).

Gloria Allred

Attorney

Alleged abuse of litigation pressure mechanisms and procedural manipulation

(as pleaded).

Lisa Bloom

Attorney

Alleged coordination with media strategy in litigation contexts

(as pleaded).

Benjamin Brafman

Defense Attorney

Named intermediary in entertainment-industry litigation contexts

(as pleaded).

Alex Spiro

Attorney

Referenced in filings involving coordinated legal-media activity

(as pleaded).

Quinn Emanuel Urquhart & Sullivan

Law Firm

Named institutional participant in litigation strategy allegations

(as pleaded).

III. FINANCIAL INSTITUTIONS — ON NOTICE

IV. DECEASED INDIVIDUALS REFERENCED IN PLEADINGS

V. REGULATORY & JUDICIAL AUTHORITIES (Procedural Context)

Final Regulatory Position

Meyer Lansky’s Hollywood Legacy — Structural Financial Lineage

Public Record / Court Filings

ON NOTICE: Matters Before the Courts — Media Platforms, Criminal Filings, and Regulatory Exposure

Publisher: ShockYA.com

Date: December 31, 2025

This article does not speculate and does not allege guilt. It records the existence of criminal filings, pleadings, notices, and investigative referrals that are asserted in court proceedings and before competent authorities. These matters are referenced

2 thoughts on “ANALYST WARNING – NETFLIX / WARNER MERGER – UNDER REGULATORY ENFORCEMENT”

Comments are closed.

[…] | BBC BLACKMAIL RING — STARMER POSITION ON CHILD SEX ABUSE AND FIXED SPORTS BETTING | ANALYST WARNING — NETFLIX WARNER MERGER UNDER REGULATORY ENFORCEMENT | ANTIGUA LEGAL PROCEEDINGS — ARCHIVAL SHOCKYA […]

[…] | BBC BLACKMAIL RING — STARMER POSITION ON CHILD SEX ABUSE AND FIXED SPORTS BETTING | ANALYST WARNING — NETFLIX WARNER MERGER UNDER REGULATORY ENFORCEMENT | ANTIGUA LEGAL PROCEEDINGS — ARCHIVAL SHOCKYA […]