Procedural Countdown

Supreme Court of the Eastern Caribbean · St. John’s, Antigua & Barbuda

January 16 · 9:00 AM (AST)

This is not a protest. This is procedure.

the Supreme Court of Antigua & Barbuda

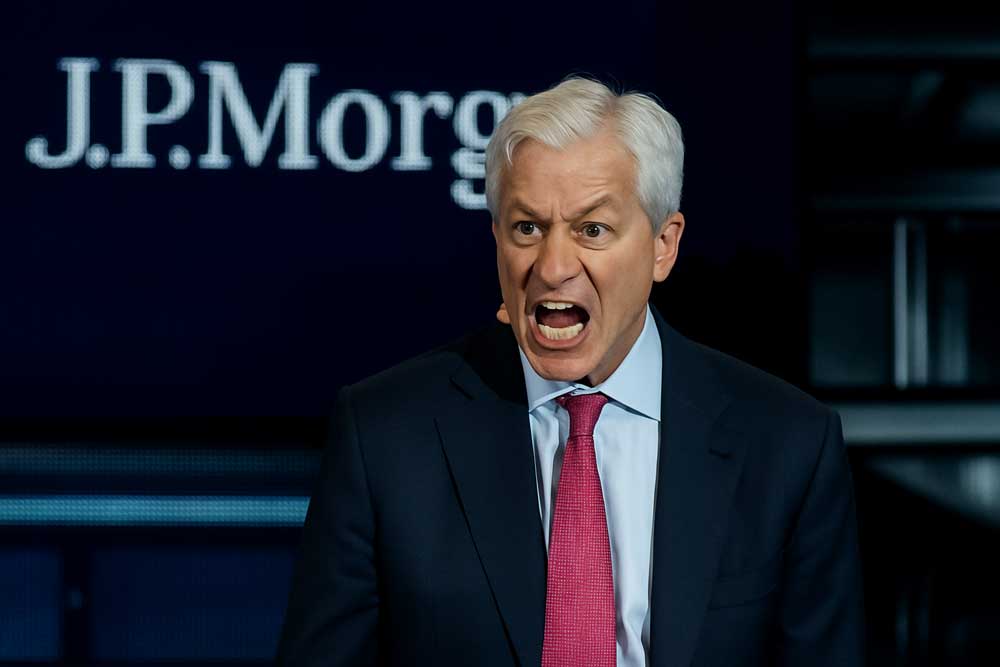

Jamie Dimon represents a banking era built on procedural control, regulatory capture, and the assumption that markets never truly face consequences. What rattles that posture isn’t public criticism or headlines — it’s jurisdiction, default, and enforceable process.

Prime Minister Gaston Browne Announces the NEO Citizen Portal

As part of the New Economic Order (NEO), Prime Minister Gaston Browne has announced the launch of a Citizen Portal—a public-facing digital gateway designed to connect lawful procedure directly to the people it serves.

The Citizen Portal represents a structural shift in governance. Rather than concentrating participation within opaque institutions, the portal provides citizens with transparent access to information, recognition pathways, and participatory mechanisms embedded within the NEO framework.

Under NEO, the Citizen Portal functions as more than a website. It is a procedural interface—allowing citizens to see how decisions are made, how resources are allocated, and how restoration, service delivery, and economic participation are sequenced following lawful outcomes.

For Small Island Developing States (SIDS), the portal establishes a new standard of democratic infrastructure. Citizens are no longer passive recipients of policy; they become recognized participants in a transparent, rules-based system that prioritizes dignity, repair, and long-term stability over extraction.

The Citizen Portal reflects NEO’s core principle in action: governance works best when procedure is open, participation is real, and being human is enough.

Why Fixed Sports Betting and CSAM Pipelines Shut Down Under NEO

NEO does not attempt to police the internet or micromanage markets. It removes the economic conditions that allow harmful networks to function. When profit disappears, pipelines collapse.

How War and Pandemics Lose Scale Under NEO

NEO does not claim to abolish conflict or disease. It removes the economic incentives and amplification mechanics that allow them to scale, persist, and repeat. When profit, opacity, and delay are removed, escalation becomes irrational.

WAR

1) War Finance Becomes Unserviceable

Large-scale conflict requires predictable financing, insurance, logistics, and settlement. Under NEO, lawful procedural outcomes introduce recognition-based gating across these rails.

- Access to clearing and settlement becomes conditional.

- Insurance and reinsurance price immediate exposure, not deferred risk.

- Trade finance corridors require transparency to remain recognized.

When financing cannot move cleanly or cheaply, escalation stalls. War does not end by decree—it loses its balance sheet.

2) Reconstruction Outperforms Destruction

Extraction economics reward destruction first and repair later. NEO reverses the sequence.

- Capital access prioritizes repair and stabilization.

- Returns are indexed to risk reduction and restoration.

- Destruction increases exposure; reconstruction reduces it.

When rebuilding is the profitable path and destruction is not, capital reallocates accordingly.

3) Attention and Arms Markets Are Repriced

Modern conflict scales through attention and supply co-travel. NEO introduces lawful exposure to amplification and logistics misuse.

- Distribution partners face recognition risk when enabling escalation.

- Supply chains require corridor sanitation to retain access.

Without amplification and reliable supply, conflicts de-escalate.

PANDEMICS

4) Early Transparency Is Rewarded, Not Punished

Pandemics scale when early disclosure is costly and delay is survivable. NEO flips that incentive.

- Early reporting unlocks stabilization support.

- Delay increases immediate exposure and cost.

- Truth becomes protective rather than punitive.

When transparency reduces risk, outbreaks are contained earlier.

5) Health Systems Are Financed as Risk Reduction

Under NEO, public health capacity is treated as a systemic stabilizer, not a discretionary expense.

- Standing facilities finance surveillance, testing, and surge capacity.

- Returns are measured in avoided loss and continuity.

Stronger baselines mean fewer shocks and faster containment.

6) Supply Chains Lose Panic Premiums

Pandemics worsen when supply chains are opaque and speculative. NEO introduces procedural oversight that removes panic pricing.

- Essential goods corridors are protected and transparent.

- Speculative hoarding increases exposure rather than profit.

With panic premiums removed, scarcity does not cascade.

CROSS-CUTTING MECHANISMS

7) Immediate Risk Replaces Deferred Consequence

Both war and pandemics persist when consequences are delayed. NEO converts deferred risk into immediate balance-sheet exposure.

- Recognition risk is ongoing, not one-time.

- Settlements are replaced by structural remedies.

When downside is immediate and uncapped, escalation stops paying.

8) Service Replaces Extraction

NEO shifts capital from extraction to service: energy stability, food security, housing, health, and logistics.

- Servicing stability reduces exposure.

- Enabling harm increases it.

Capital follows the safer path.

The Outcome

War and pandemics stop scaling because they stop paying.

No bans. No censorship regimes. No spectacle. Just lawful procedure aligning money, risk, and consequence.

When escalation becomes economically irrational and prevention becomes profitable, systems choose stability.

1) Capital Friction Replaces Capital Flow

Illicit pipelines depend on low-friction movement of money: rapid settlement, opaque routing, and reversible anonymity.

Under NEO, lawful procedural outcomes introduce:

- recognition-based transaction gating,

- court-supervised routing,

- and conditional access to clearing and settlement.

The result is not a ban—it is delay, visibility, and cost. Once friction exceeds profit margins, operations shut themselves down.

2) Risk Becomes Immediate, Not Deferred

Harmful markets survive by deferring consequence—counting on settlements, time, or jurisdictional gaps to postpone accountability.

NEO converts deferred risk into immediate balance-sheet exposure:

- standing risk tied to procedural outcomes,

- loss of recognition rather than post-hoc fines,

- and supervisory escalation that cannot be priced as a cost of doing business.

When downside is immediate and uncapped, capital exits.

3) Corridor Sanitation Removes Co-Travel

Illicit activities scale by co-traveling with legitimate commerce: advertising rails, payment processors, data services, and logistics.

NEO introduces corridor sanitation through lawful oversight:

- separation of lawful and unlawful traffic,

- access conditions tied to transparency,

- and recognition-based participation.

When co-travel is removed, scale collapses. Isolated actors cannot reach mass markets or monetize attention.

4) Settlement Is Replaced by Structural Remedy

Historically, many harmful activities survived because consequences arrived as settlements—finite, negotiable, and survivable.

NEO replaces settlement logic with structural remedies:

- ongoing supervisory conditions,

- use-value repair requirements,

- and recognition thresholds that must be continuously met.

There is no “pay once and continue.” Profit models dependent on recurrence fail.

5) Advertising and Attention Markets Are Repriced

Both fixed betting and CSAM ecosystems rely on attention monetization: traffic acquisition, amplification, and resale.

Under NEO:

- attention rails carry legal exposure when misused,

- distribution partners face recognition risk,

- and amplification becomes conditional on compliance with procedural outcomes.

When attention can no longer be cheaply monetized, growth strategies evaporate.

6) Banking Incentives Flip

Banks do not shut down harmful activity by morality alone. They do so when servicing becomes risk-reducing and enabling becomes risk-creating.

NEO flips that equation:

- servicing lawful markets reduces exposure,

- enabling opaque flows increases it,

- and restoration becomes the profitable path.

When the safest balance-sheet position is non-participation, capital withdraws decisively.

7) The End State: Economic Extinction

No raids are required. No censorship regimes are imposed.

Harmful pipelines end because:

- money moves too slowly,

- risk materializes too quickly,

- scale cannot be reached,

- and profit disappears.

This is how durable systems shut down harmful markets: by making them economically irrational.

The Principle

When harm is no longer profitable, it stops.

NEO achieves this not by force, but by alignment— using lawful procedure to ensure that capital, risk, and consequence finally move together.

When courts stop deferring, when regulators are forced onto the record, and when sovereign proceedings move from noise to mechanism, the room changes. Silence stops working. Influence becomes auditable. Balance sheets stop being abstract.

That’s when anger appears.

Not because of a single allegation — but because control is no longer exclusive.

Because procedure has moved outside the usual channels.

Because outcomes are no longer managed informally.

Anger, here, is the visible emotion of an old system realizing it is being measured instead of deferred to.

And systems hate being measured.

[…] post Countdown: JP Morgan’s Jamie Dimon & Deutsche Bank Christian Sewing ‘s Judgement Day… appeared first on […]