Factual Context — Crown Prosecution Service

From 2008 to 2013, Keir Starmer served as Director of Public Prosecutions and head of the UK Crown Prosecution Service. This period coincided with key prosecutorial decisions and non-decisions affecting the case of Julian Assange, including charging posture, international coordination, and the persistence of unresolved legal exposure without merits adjudication.

This statement alleges no personal misconduct. Its relevance is institutional: the Director of Public Prosecutions sets prosecutorial posture, priorities, and tolerance for delay within the UK system. The Assange case illustrates how prolonged process, rather than adjudication, can function as an outcome in itself.

Epstein – Starmer – Mandelson – McSweeney

CSAM, Sports-Betting Risk, and Blackmail Exposure

Why Elite Risk Is Contained — and Why the System Is Now Exposed

Public-interest analysis grounded exclusively in sworn pleadings, stamped exhibits, service records, and procedural histories before the High Court of Justice of Antigua & Barbuda (ANUHCV2025/0149) and mirrored proceedings in the King’s Bench Division. Illustrative roles demonstrate systemic behaviour only. No criminal conspiracy is alleged.

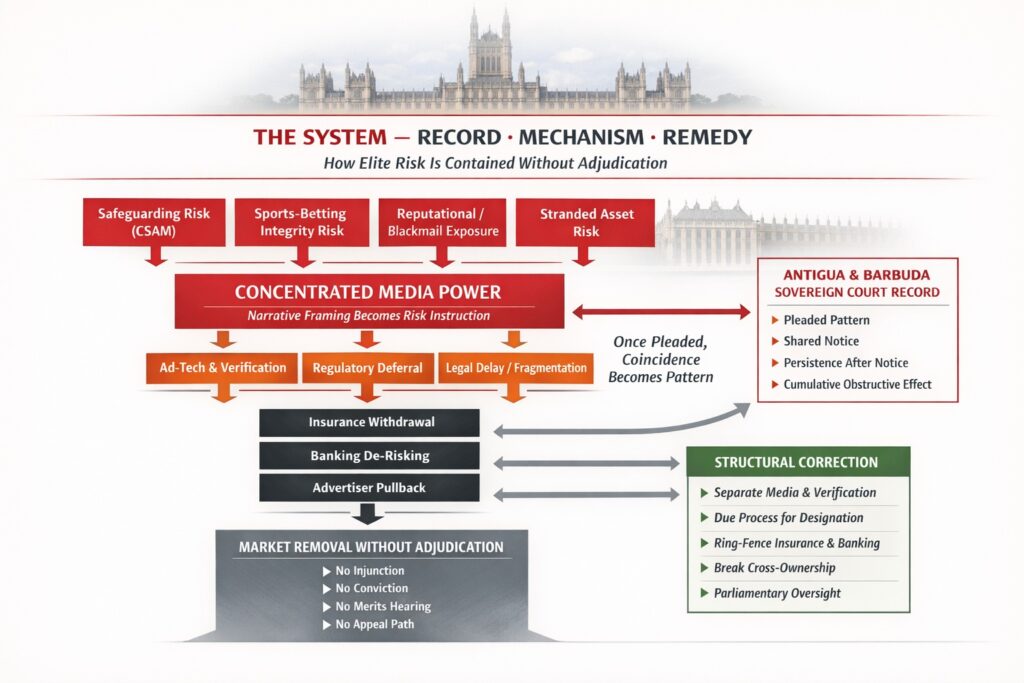

EXECUTIVE BRIEF (90-Second Read)

- Lawful systems, when combined after notice, produce exclusion without adjudication.

- Media concentration induces downstream regulatory, insurance, and banking decisions.

- CSAM, betting integrity, and blackmail operate as institutional risk vectors.

- The full suppression circuit is now retained on sovereign court record.

- Structural separation — not censorship — is the remedy.

I. WHAT “ON THE RECORD” MEANS

Once retained on a live court record, coincidence collapses into pattern. Notice replaces ignorance. Cumulative effect becomes the legal question.

II. ILLUSTRATIVE ROLES — ELITE RISK CONTAINMENT

- Mandelson — narrative mediation and access containment.

- Starmer — institutional delay via process compression.

- McSweeney — proximity management during reputational stress.

- Epstein — systemic failure stress-test.

These references describe institutional posture, not personal findings.

III. THE FIVE-VECTOR SUPPRESSION CIRCUIT

- Courts — fragmentation, delay.

- Regulators — deferral as market signal.

- Media / Verification — risk framing.

- Insurance — reputational exclusion.

- Banking — compliance de-risking.

Result: Removal without trial.

IV. CSAM, SPORTS-BETTING & BLACKMAIL — RISK VECTORS

These factors are pleaded as containment triggers — not accusations — explaining institutional behaviour under exposure risk.

V. THE REMEDY

- Separate narrative power from enforcement.

- Mandate due process for verification flags.

- Ring-fence insurance and banking decisions.

- Impose cross-ownership limits.

THE RECORD, THE MECHANISM, THE REMEDY

A Deep-Dive on Media Inducement, Elite Risk Management, and Why the Antigua Filings Now Compel Urgent Reform

(Public-interest analysis grounded exclusively in sworn pleadings, stamped exhibits, service records, and procedural histories before the High Court of Justice of Antigua & Barbuda (ANUHCV2025/0149) and mirrored proceedings in the King’s Bench Division (KB-2025-001991). Illustrative roles are deployed solely to demonstrate systemic behaviour; no criminal conspiracy is alleged.)

EXECUTIVE BRIEF (For MPs, Judges, Regulators — 90 seconds)

- A multi-vector suppression circuit—courts, regulators, media/advertising/verification, insurance, banking—has operated over years to exclude enterprises and individuals from markets without adjudication on the merits.

- Each vector is lawful in isolation; combined and after repeated notice, the predominant effect is obstructive.

- This circuit is now fully pleaded, evidenced, and retained on a live sovereign record in Antigua & Barbuda, with parallel reliance in London.

- The enabling condition is concentrated media power exercising inducive effect on downstream enforcement layers.

- Recent Epstein-file disclosures (February 2026) illustrating containment of elite reputational risk underscore the mechanism’s continued operation.

- Structural separation—not censorship—is the required remedy.

I. WHAT “ON THE RECORD” MEANS

The consolidated Antigua proceedings (ANUHCV2025/0149) and mirrored King’s Bench filings assemble years of primary documents—media outputs, verification flags, insurance refusals, banking decisions, regulatory deferrals, and procedural histories—into a single pleaded mechanism.

Once formally pleaded and retained:

- Pattern displaces coincidence

- Notice displaces ignorance

- Cumulative effect displaces isolated intent as the operative legal question

Exposure shifts plausibility into accountability risk.

II. THE ILLUSTRATIVE ROLES — ELITE RISK CONTAINMENT

(No allegation of conspiracy)

The record uses public figures illustratively to explain how the suppression circuit manages high-level reputational risk. The February 2026 Epstein-file disclosures provide a timely stress test.

- Peter Mandelson — Narrative & Access Mediation

Demonstrates elite orchestration of “managed transition,” “stability,” and “realism” framing that normalises delay and containment. The 2026 disclosures triggered immediate political consequences yet reveal layered protection via media moderation and process extension. - Keir Starmer — Legal & Institutional Compression

Illustrates process-first governance that decisively extends timelines and fragments proceedings when systemic risk materialises. - Morgan McSweeney — Political & Proximity Management

Exemplifies close-quarter political management insulating core actors during reputational crises. The February 2026 resignation amid Mandelson–Epstein disclosures shows how proximity to containment can itself become a liability once exposure crosses thresholds. - Jeffrey Epstein — Ultimate Stress Test

The paradigm case of system behaviour when elite reputational risk threatens contagion. Containment—pre- and post-exposure—relied on the same vectors: media framing, legal delay, financial de-risking, and narrative control. The 2026 disclosures confirm persistence.

Why timing matters: Legacy infrastructure (fossil, media, political) faces stranded-asset and liability risk. Time is preserved by process; legitimacy moderated by media; oxygen moderated by finance.

III. THE FIVE-VECTOR SUPPRESSION CIRCUIT (AS PLEADED)

- Courts — serial delay, fragmentation, narrowed discovery – merits avoided

- Regulators — deferral converts silence into market-wide instruction

- Media / Advertising / Verification — risk-laden framing and automated flags trigger revenue denial without appeal

- Insurance — reputational exclusions render lawful operation impossible

- Banking — compliance de-risking completes capital starvation

No formal injunction required. The outcome is the functional equivalent.

IV. WHY THIS CROSSES THE LEGAL LINE

- Each act is lawful alone

- Predominantly obstructive by effect when repeated, informed, and relied upon to prevent merits review

Justice delayed accidentally = error.

Justice delayed deliberately, or predictably = obstruction by effect.

V. MEDIA INDUCEMENT — THE UK-SPECIFIC FACT

Inducement requires affirmative encouragement, foreseeable reliance, and material downstream contribution.

The record pleads:

- Repeated risk framing relied upon by advertisers, verifiers, insurers, and banks

- Predictable compliance treatment of major UK media outputs as risk inputs

- Persistence after explicit notice

- Cumulative exclusion: coverage – flags – insurance/banking withdrawal – market exit without merits hearing

UK media concentration amplifies inducive scaling.

VI. THE MEDIA MONOPOLY (CONTEXTUAL)

News & Distribution

BBC, ITV, Sky (Comcast), NBCUniversal, CBS (Paramount), ABC (Disney), FOX, Daily Mail / MailOnline, The Guardian, Financial Times, Reuters, Bloomberg.

Advertising & Verification

DoubleVerify, Integral Ad Science, Oracle Moat, WPP, Omnicom, Publicis, Interpublic Group, Dentsu.

Finance & Insurance

Banks: JPMorgan Chase, HSBC, Deutsche Bank, UBS, Bank of America, Citigroup.

Insurance/Reinsurance: Lloyd’s of London, AXA, Zurich Insurance, Swiss Re, Munich Re.

Aligned risk frameworks enable exclusion without trial.

VII. UK APPEAL — ANTIGUA AS CORE EVIDENCE

In the King’s Bench Division (KB-2025-001991), the retained Antigua record supplies the indispensable “system view”: pattern beyond coincidence, notice shared across sectors, and cumulative effect on access to justice—now relied upon in London.

VIII. CONVERGENCE

Post-exposure, independent high-damage parties are aligning around the Antigua record because it uniquely identifies a common mechanism, pleads shared notice, and remains intelligible across common-law jurisdictions.

Evidence convergence—not coordination.

IX. THE REMEDY — STRUCTURAL CORRECTION

- Separate narrative from enforcement: media – verification – market punishment

- Mandate due process for designations: notice, transparency, appeal before market-wide penalties

- Ring-fence insurance & banking: prohibit reliance on unresolved allegations or opaque flags

- Impose cross-ownership limits: no single group controls news, advertising, verification, and platforms

- Establish cross-committee oversight: Culture, Business, Treasury, Justice

X. FINDINGS PARLIAMENT CAN ADOPT (VERBATIM)

Concentration of media ownership and allied enforcement functions has enabled lawful acts, taken together, to exclude enterprises and individuals from markets without judicial determination on the merits. The pleaded and retained record demonstrates notice, foreseeability, and cumulative obstructive effect, warranting structural regulation and divestiture where roles overlap.

MP BRIEFING INSERT (FOR IMMEDIATE CIRCULATION)

Media Inducement, Market Exclusion, and the Antigua Court Record

Purpose: To summarise why the Antigua & Barbuda court record raises urgent questions of market integrity, access to justice, and media concentration requiring Parliamentary attention.

Why Parliament Should Care:

- Rule of law: adjudication on the merits

- Competition: exclusion by process, not performance

- Media power: inducive effects at scale

- Finance: private risk frameworks replacing courts

What Is New: the entire suppression circuit is now visible in one record; notice and persistence after notice are pleaded.

What Parliament Is Asked to Do: examine inducive effects, review due-process gaps, assess reliance on unresolved allegations, and consider structural separation.

Safe Language:

The issue is not whether any single institution acted unlawfully, but whether the cumulative operation of lawful powers has produced systematic exclusion without adjudication.

The February 2026 Epstein disclosures—triggering resignations, exits, and political crisis—confirm the mechanism’s ongoing operation.

Break up the monopoly.

Restore adjudication on the merits.

Separate narrative power from enforcement power.

This is no longer theory. It is record.

Break the monopoly. Restore adjudication on the merits.

ShockYA · REAL TALK · Sovereign Insert · 9 February 2026