Notice to Risk Analysts, Insurers, and Compliance Officers

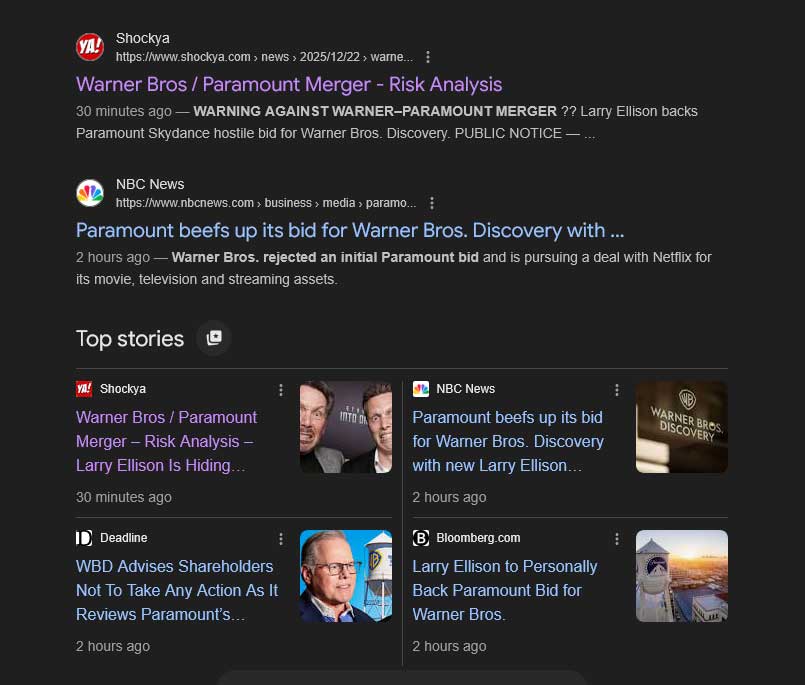

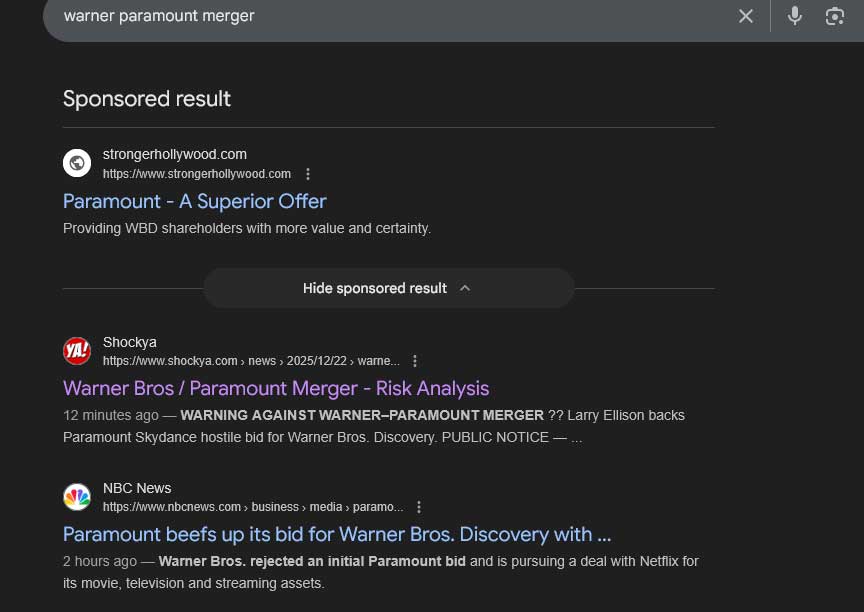

The appearance of this article as a top organic Google News result for the query “Warner Paramount merger” — positioned between paid Paramount advocacy and legacy media reporting — constitutes a material market signal.

Search ranking at this level does not function as an opinion endorsement. It reflects that the subject matter is: news-relevant, widely queried, timely, and materially significant to stakeholders evaluating transactional, regulatory, and reputational risk.

In risk, insurance, and compliance practice, such visibility triggers duty-to-inquire standards. Once a warning analysis is publicly indexed, discoverable, and ranking at scale, it forms part of the constructive notice record for boards, advisors, lenders, insurers, and counterparties.

Risk implication:

Whether allegations are ultimately substantiated or disputed,

their verified presence in top-ranked search results means they are

known, searchable, and unavoidable in due-diligence review.

Failure to assess them may expose decision-makers to

governance, insurance, and disclosure risk.

This article is therefore published as a public-interest risk analysis, not as sensational commentary. Its visibility alone confirms that the issues raised are material to market participants and cannot be credibly dismissed as obscure, private, or non-actionable.

MARKET VISIBILITY — CONSTRUCTIVE NOTICE

The screenshot above shows Shockya’s risk analysis appearing as a top organic Google News result for the Warner Bros / Paramount merger, positioned alongside and between coverage from major legacy outlets.

Search placement at this level does not function as endorsement. It reflects that the subject matter is news-relevant, widely queried, timely, and materially significant to market participants evaluating transaction, regulatory, insurance, and governance risk.

In professional risk, insurance, and compliance practice, such visibility triggers a duty to inquire. Once analysis is publicly indexed, discoverable, and ranking at scale, it becomes part of the constructive notice record for boards, officers, advisers, lenders, insurers, and regulators.

Whether issues raised are ultimately substantiated or disputed, their verified presence in top-ranked search results renders them known, searchable, and unavoidable in any good-faith due-diligence review.

NOTICE OF CONSTRUCTIVE PUBLIC DISCLOSURE

This article analyzes public reporting, market disclosures, and governance risk. No explicit material is shown. Publication establishes timestamped notice to boards, officers, counterparties, insurers, and regulators.

Billionaires do not deploy personal guarantees at this scale unless time is short, underwriting resistance exists, or disclosure pressure is rising.

THE BID — STRIPPED OF SPIN

- Offer: ~$30 per share for WBD

- Structure: Cash + assumed debt + Ellison personal backstop

- Nature: Hostile, accelerated, media-coordinated

- Reality: Banks didn’t want the full exposure — Ellison absorbed it

WHY A PERSONAL GUARANTEE IS A RED FLAG

In large-cap M&A, clean deals are underwritten by syndicates. Personal guarantees appear when risk is asymmetric.

- Traditional underwriting resistance

- Expected regulatory or antitrust scrutiny

- Potential litigation or disclosure exposure

- Urgency driven by competitive or informational timing

WHAT WBD SHAREHOLDERS ARE BEING ASKED TO DECIDE

Reasons to Tender

- Immediate liquidity

- Debt overhang relief

- Financing certainty

- Premium in a volatile market

Reasons to Pause

- Possible fire-sale pricing of irreplaceable IP

- Integration risk with Paramount/Skydance

- DOJ / FTC intervention

- Pressure to sell before full sunlight

THIS IS NOT JUST A MEDIA DEAL

Ellison’s interests intersect across cloud infrastructure, AI training data, compute, and distribution control. Content libraries are no longer entertainment — they are strategic fuel.

THE QUESTION NO ONE IS ASKING (BUT REGULATORS WILL)

Why does this deal require a personal guarantee at all?

REGULATORY & GOVERNANCE FLASHPOINTS

- Antitrust: Horizontal + vertical consolidation

- National security: Data, cloud, AI training sets

- Disclosure risk: Any adverse finding detonates guarantor exposure

- Timing risk: Hostile acceleration implies anticipated events

SHOCKYA BOTTOM LINE

This is one of the most aggressive and time-compressed takeover plays in modern media history. Either it closes and redraws Hollywood — or it fails, and the reason why becomes the real story.

© Shockya Real Talk. Published in the public interest. This article establishes constructive notice to Warner Bros. Discovery directors and officers, Paramount Global leadership, financing counterparties, insurers, and regulators.

Shockya Real Talk — Related Investigations

The following Shockya articles reference publicly reported facts, court-filed materials, and governance risks involving major media power brokers. Links provided for record, context, and constructive notice.

Larry Ellison / Oracle / Paramount Global

-

Oracle’s Larry Ellison & Son David Ellison’s Child Porn, Fixed Sports Betting & Paramount Global Legal-Blackmail Network — Now Exposed

Investigative reporting examining alleged systemic risk involving Oracle infrastructure, Paramount Global ownership, and Ellison-linked entities referenced in court filings.

-

Warner Brothers Executive Board — Systemic Risk Assessment — CSAM & Rigged Sports Betting Crimes Linked to Paramount Global and Ownership

Governance-focused analysis identifying risk exposure tied to Paramount Global, ownership structures, and affiliated financiers.

-

WARNING: CSAM, Fixed Sports Betting & Transnational Lawfare — Public Criminal Referral

Public-interest notice summarizing alleged cross-border patterns involving media companies, banks, and infrastructure providers.

Barry Diller / IAC / Paramount Context

-

Barry Diller’s “Gay-Cation” Pics Turn Up the Heat on Paramount Global

Examines public-record material and reputational scrutiny involving Barry Diller within broader Paramount Global governance concerns.

-

Wake Up: The Media-Legal Cartel’s Spell Is Breaking

Broad Shockya investigation naming long-standing media power brokers, including Barry Diller, in the context of systemic control.

Archival Shockya Coverage (Historical Context)

-

Barry Diller Sues Alki David Over BarryDriller.com (2012)

Historical reporting on litigation between Barry Diller and Alki David, relevant to long-running disputes over media parody and control.

-

BarryDriller.com Publishes New Logo Per Request of Barry Diller of Aereo (2012)

Follow-up coverage documenting interactions during the Aereo era.

Published in the public interest. No explicit material shown.

This index establishes constructive notice to boards, officers,

counterparties, insurers, and regulators.

Beyond legacy distribution and governance failures, court filings across multiple proceedings include sworn testimony from witnesses and victim statements alleging a deeper systemic culture of abuse, coercion, and human trafficking within segments of the media-legal-technology ecosystem. These filings assert that vulnerable individuals were exploited in environments characterized by extreme power imbalances, reputational control, and financial leverage, which allegedly suppressed reporting, limited accountability, and redirected scrutiny toward economically weaker targets. While such allegations are grave and contested, their documented presence in sworn court records constitutes a non-dismissible institutional risk that boards, insurers, and regulators are obligated to assess.